Are Farm bankruptcies on the rise in 2025?

By Lindsay Humphrey

Are Farm Bankruptcies on the rise in 2025!

Recent headlines note that 2025 agricultural bankruptcies exceed 2024 levels, even though the year is only half over. Does that mean your neighbor is quietly closing up shop? Not likely. In fact, the headline might catch your attention, but it doesn’t hold as much merit as you might think.

“Agricultural is a very big term and encompasses more than just row crop farms and cattle ranches,” Karst said. “That includes forestry, aquaculture, and horticulture, just to name a few other areas that these farm bankruptcies could be talking about.”

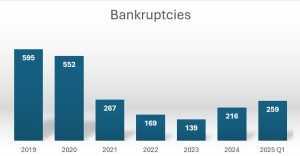

It is true that farm bankruptcies are on the rise in 2025. The data doesn’t lie even if the headlines are a bit dramatic.

In 1987, farm bankruptcies recorded an all-time high at 5,788. It was a tough time to be in agriculture and only those who lived through it can attest to that. Between 2019 and 2023, farm bankruptcies were on a steady decline before a small spike in 2024.

“If 2025 continues with the same growth as we’ve seen in the first seven months, we’re looking at 1,000 bankruptcies which would be the highest we’ve seen in the last several years,” Karst explained. “The maps show that the Midwest leads the way with 71 farm bankruptcies so far, followed closely by the southeast at 62. When you stop and think about it, that’s where a lot of agriculture happens so it’s logical.”

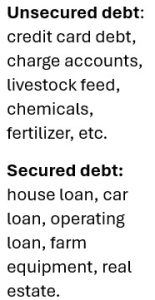

Bankruptcy sounds like a dirty word in business and can easily feel like a death sentence, but that’s not necessarily true. There are two types of agricultural bankruptcy, and one has nothing to do with closing a business.

“Chapter seven bankruptcy, that’s a complete liquidation, that’s the end where everything is sold to pay creditors,” Karst said. “Chapter 12 is a reorganization of finances. I’m not a banker or a financial specialist, but in Chapter 12, the unsecured debt is likely dismissed and the farmer submits a plan to pay back their secured debt.”

In 2024, all of the 216 farm bankruptcies were chapter 12.

“Filing bankruptcy is always serious business and an indicator that times are more challenging than they have been,” Karst said. “It’s not always the end of the family farmer or anything like that, but it does mean we need to be careful and pay close attention to what we’re doing.”

What should we be paying attention to and why is 2025 turning out to be so difficult for farmers?

“Bankers are being guarded about their outlook for the end of 2025 going into 2026,” Karst said. “We’ve had a few farmers and bankers sell a farm to raise cash or pay down debt. And even some who were selling off 80 or 160 acres to shore up their working capital. Unfortunately, we’ve had to help on some receiverships this year.”

Every scenario is different, but the basic principle of a receivership is that the bank needs an uninterested third party to come in and take control of an operation to ensure debt will be paid.

“It’s not tasteful work, nor is it pleasant for anyone involved, but we try to be a helping hand to the person in that situation so that they can get out of that debt and get back to farming,” Karst said. “It’s a misconception that we’re working for the bank in that situation. The only one we have a legal contract with is the judge within the court system who ordered the receivership.”

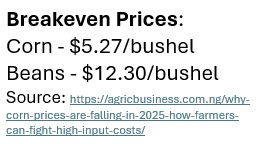

Most operating loans are secured by growing crops. If commodity prices or yields aren’t good enough to turn a profit, operating loans can’t be paid back. That’s what puts a furrow in the banker’s brow. As of the first of August, commodity prices significantly lower than breakeven for corn, soybeans and wheat.

Currently, the USDA predicts corn bringing $4.20 per bushel and beans $10.25. Of course, those numbers still have time to change going into fall. On August 5, prices were: corn – $3.86 (CIN) and $4.05 (KCM). For soybeans – $9.57 (CIN) and $10.04 (KCM). (Source: USDA AMS Daily Market Rates)

Currently, the USDA predicts corn bringing $4.20 per bushel and beans $10.25. Of course, those numbers still have time to change going into fall. On August 5, prices were: corn – $3.86 (CIN) and $4.05 (KCM). For soybeans – $9.57 (CIN) and $10.04 (KCM). (Source: USDA AMS Daily Market Rates)

Declaring bankruptcy, no matter the cause or industry, is a difficult topic to discuss and even more so to endure. It’s often a scary and lonely place to be. If you know someone going through this difficult financial situation, it’s important to check on them as the emotional toll can easily become overwhelming.

Farmer-specific resources are available. For immediate mental health needs, contact one of these national hotlines:

- Farm Aid Hotline: 800-327-6243 (Mon.-Fri. 9 a.m. – 5 p.m. ET)

- 988 Suicide and Crisis Lifeline: 988 (24/7)

- 2-1-1 (24/7)

Karst has a whole lot more to add about commodity prices, crop outlook and everything else that happened during the second quarter. Check back for his quarterly update for more.