Farmland Values Stay Strong Through 2025

By Halderman

One month ago, I wrote about farmland values remaining strong through 2025. Contrary to reports from the western Corn Belt Indiana, Ohio and Michigan sales results for Halderman are strong generating an all-time high value on our WAPI analysis. This is a nominal number and arguably 2022 farmland values were higher when adjusted for inflation.

Halderman evaluates our farmland sales using WAPI data. We take any sale with 90%+ cropland and no improvements and divide the sales price per acre by the Weighted Average Productivity Index for the soils on that farm. In Indiana, Ohio, and Michigan soils are rated for their ability to produce corn. The corn yield WAPI scores range from below 100 to 188 bu./acre in Indiana. That does not indicate what they will actually produce, but they give us a tool to compare one farm to another on a key element of value, the soil.

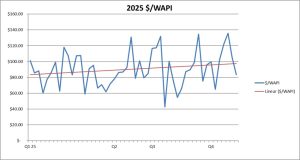

Therefore, if a farm sells for $15,000/acre and the WAPI is 161 bu./acre the WAPI score is $93/bu. of productivity index. The 2025 average WAPI score is now over $90/bu. Below is a chart of the qualifying sales through the first ten months.

You can see the general trend is strength. This also shows the wide range of variability in the sales. Every farm is unique and in a different location, therefore the wide variation. That is where Halderman Can Help. If you want to discuss our thoughts on farmland values for your specific farm, we can provide that insight and thoughts on the best sale method, as needed.

You can see the general trend is strength. This also shows the wide range of variability in the sales. Every farm is unique and in a different location, therefore the wide variation. That is where Halderman Can Help. If you want to discuss our thoughts on farmland values for your specific farm, we can provide that insight and thoughts on the best sale method, as needed.

Yields in 2025 are reported to be above average for both corn and soybeans. Farm incomes are dependent on yields and prices. Assuming the February price for crop insurance at $4.70/bu. (many producers buy federal crop revenue coverage using the February price) times 205 bushels per acre yield (USDA projected ave. yield for IN in the August crop report) generates a gross income of $963/acre. This at the high end of the range of costs per acre. Corn yields can be well above 205 bushels/acre and cash corn prices are below $4.70/bu. but you can see why farm incomes are not as much of a drag on land values and lease rates for 2026 as one might expect. When combined with interest rates declining a little the final quarter of 2025 might prove to be the strongest once again.

Halderman watches developing trends such as this and considers the long term as well as short term impacts on farmland investments, farms we manage and how it might impact the farmland market. If you want help, choose someone with local knowledge combined with the “world” view of developing trends and issues that impact your farm. Please reach out to us at 800-424-2324 or www.halderman.com to explore what might be interesting to you.