The True Story Behind U.S. Soybean Exports: China’s Pullback and Its Impact on American Farmers

By Halderman

Almost daily for the past month the US Farmer reads about soybean exports declining, zero sales to China, tariffs are hurting our exports of soybeans, and yields will be high but with reduced exports prices are below breakeven. They are inundated with negative news, except for big yields. What is the true story around soybean exports, especially those to China?

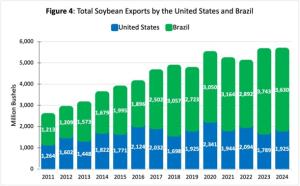

USDA is projecting the US farmers to produce 4.3 B bushels of soybeans this summer. They project our total exports to be 1.925 B bushels or 45% of the total crop. Over the past five years the average is close to 50%. The chart below details the exports from the US and Brazil the past 13 years.

Figure 4: Total Soybean Exports by the United States and Brazil

Note: Exports by calendar year since the countries have different marketing years

Source: USDA and Secex/Brazil

Brazil surpassed the US in soybean exports in 2013 and are not looking back. You can see a large drop in our exports in 2018, the first tariff/trade war with China. I expect the 2025 number to be even lower since sales to China ended in May and no sales are currently reported. China is sourcing all their fall soybean needs from Brazil and Argentina based on recent sales announcements and make it very clear until a different trade deal comes about, they are buying zero from the US. The chart below shows the total US exports and the exports to China. This is the normal period where China buys a lot of US soybeans, but so far into early October there are zero.

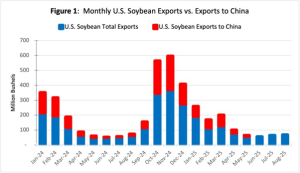

Figure 1: Monthly U.S. Soybean Exports vs. Exports to China

Source: Foreign Agricultural Service (FAS), USDA

China accounted for 51% of our total exports in 2024. If you assume 44% of the total crop is exported taking away Chinese demand could amount to 20-25% of the total US crop remaining domestically or looking for another buyer. Assuming those beans go back on the market the price impact could be $1 – $2/bushel. If you assume a price of $11/bushel, 20% is $2.20/bu. the impact to the US grower is substantial and therefore why you might read that President Trump promises to use some of the tariff “profits” to help the US farmer.

That is the near-term impact. Longer term this encourages other South American countries and Brazil to expand production to meet the demand from China. This creates long term competition and that is a negative factor for US producers going forward.

Domestic demand continues to grow. Soybean crush sets a record each year and the demand for soy oil is growing as Renewable Diesel becomes a larger and larger portion of the fuel supply in the US. Most US airlines committed to switching to renewable diesel by 2030. This is helping offset the loses from reduced exports. Also the lower prices are encouraging some buyers to buy more beans. One example is that Taiwan recently announced a large trade agreement with the US.

Halderman watches developing trends such as this and considers the long term as well as short term impacts on farmland investments, farms we manage and how it might impact the farmland market. If you want help, choose someone with local knowledge combined with the “world” view of developing trends and issues that impact your farm. Please reach out to us at 800-424-2324 or www.halderman.com to explore what might be interesting to you.